How do I read my Form 1099-B?

A Form 1099-B reports your capital gains and losses from selling or disposing of property, including bitcoin. Strike will issue you a 1099-B if you sold or otherwise disposed of any amount of bitcoin within the Strike app during the preceding tax year. You can read more about which bitcoin-related transactions are considered taxable or non-taxable.

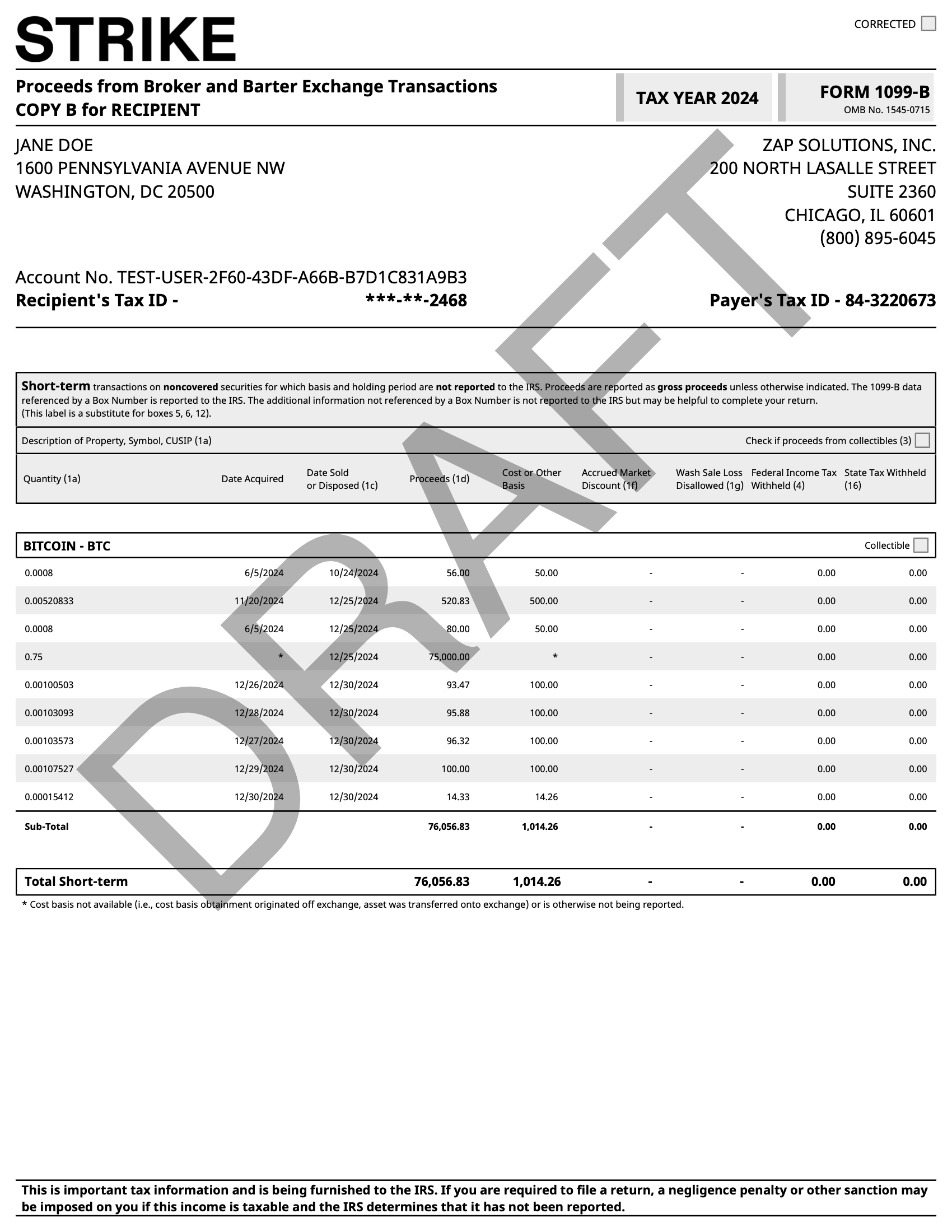

Reading your 1099-B

Your 1099-B includes your account information and a table summarizing your taxable bitcoin transactions. Here's an explanation of the information in the table:

- Date acquired: The date you originally bought bitcoin on Strike. If bitcoin was added from an external source, then this will show as “*”, since the actual purchase date is unknown.

- Date sold or disposed: The date you sold or exchanged bitcoin on Strike.

- Proceeds: The amount of money you received for selling bitcoin.

- Cost or other basis: The original price you paid for bitcoin. If bitcoin was added from an external source, then this will show as “*”, since the original purchase price is unknown.

- Total Short-Term: The total gains or losses from selling bitcoin held for one year or less.

- Total Long-Term: The total gains or losses from selling bitcoin held for more than one year.

The “Accrued market discount” and “Wash sale loss disallowed” do not apply to bitcoin transactions made on Strike, so these will always be shown as $0.00. Since there is no tax withheld on Strike, the “Federal Income Tax Withheld” and “State Tax Withheld”will also appear as $0.00.

What is my cost basis?

Your cost basis is simply the original price you paid to acquire your bitcoin. For tax purposes, when you sell bitcoin, you must determine your gain or loss by subtracting your purchase price from your sale price. If you bought bitcoin over multiple purchases at different prices, then each purchase is considered a separate “lot” with its own cost basis.

There are different methods for tracking cost basis, including FIFO (First In, First-Out), LIFO (Last In, First Out), and HIFO (Highest In, First Out). By default, Strike uses HIFO, which means the bitcoin with the highest purchase price is sold first. For any amount of bitcoin that was received into your Strike account from an external source, the original purchase price is unknown and is summarily treated as having a $0 cost basis.

Read more about HIFO cost basis here.

Why are there multiple rows for a single bitcoin sale?

A single sale of bitcoin can occupy multiple rows within your taxable transactions table. This can occur if the amount of bitcoin you’re selling is larger than your highest-priced lot, requiring the sale to pull from multiple lots purchased at different prices.

This is common if you bought bitcoin in multiple smaller purchases (such as through recurring purchases) and later sold a larger amount all at once. With HIFO, your sale will pull from multiple bitcoin lots, starting with the one purchased at the highest price and then moving to the next highest-priced lot until the full sale amount is covered.

Example Form 1099-B

© 2025 NMLS ID 1902919 (Zap Solutions, Inc.)